With only six weeks left in the session, we have reached the time where House bills that have not yet received a hearing start looking less and less like future laws. This week also looks to be the beginning of the “have your rulebook handy” time of the session as demonstrated by the many attempted (and some successful) Points of Order (POO). As we move into the last month of session, parliamentary maneuvers and behind the scenes horse-trading will be driving more of the legislative action.

The Senate this week passed their version of HB1 (the state budget) and sent it back to the House. With significant differences between the versions concerning education, transportation, and border security, the two chambers will each appoint 5 members to serve on a conference committee that will attempt to reach a compromise between the two versions.

KEY TAKEAWAYS

POOs against several key legislative items

On Tuesday, a computer glitch derailed two hot-button bills in the Texas House. Rep. Martinez-Fisher raised the POO on HB 910 (Open Carry) due to a computer-generated report that had mistakenly listed how some witnesses testified on the bill during a March public hearing. The ‘glitch’ had not only affected this bill but also HB 40 (which halts local bans on hydraulic fracturing) that was to be heard that very same day as well as almost 125 other bills. Both bills were sent back to committee, the computer problems were resolved, and were heard on second reading before the House on Friday.

In addition, on Thursday, Rep. Mary Gonzalez (D – El Paso) succeeded with a POO on HB 1690 (moves public corruption cases from Travis County’s Public Integrity Unit to the Texas Rangers). The bill was quickly returned to committee so that the mistake in its written analysis could be fixed, and it will likely be back before the House sometime next week.

Continued jockeying on House v Senate Tax relief plans

This week, the House Ways and Means Committee voted out their $4.9 billion tax relief package: HB 31, which reduce the state’s 6.25-percent sales tax rate to 5.95 percent (estimated savings of $172 per year) and HB 32 (cuts the franchise tax rate by 25 percent across the board). These bills now head to the House floor for a vote.

In the meantime, Lt. Gov. Patrick and Chairman Bonnen have been in a back-and-forth exchange concerning whose tax package is ‘better’. Lt. Gov. Patrick has stated that he wouldn’t support a budget that doesn’t include property tax cuts, and the House appears to be locked in on a sales tax and franchise tax relief plan. It appears that we may be headed for a tax relief plan showdown between the Senate and House in the coming weeks

HHSC Sunset Bill passes the Senate

The Senate this week passed SB 200, which reorganizes Texas’ five health and human services agencies by a unanimous 31-0 vote. Some of the key highlights of this legislation include: Moving client services at DSHS to HHSC in 2016, abolishing and transferring DARS functions to HHSC in 2016, abolishing and transferring DADS functions to HHSC in 2017, and continuing DFPS and DSHS as independent agencies until 2023.

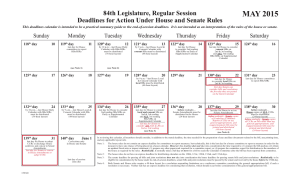

Session Deadlines and Schedule:

WHAT TO LOOK FOR NEXT

- The House adjourned until 12:00 p.m., Monday, April 20, 2015.

- The Senate adjourned until 2:00 p.m., Monday, April 20, 2015.